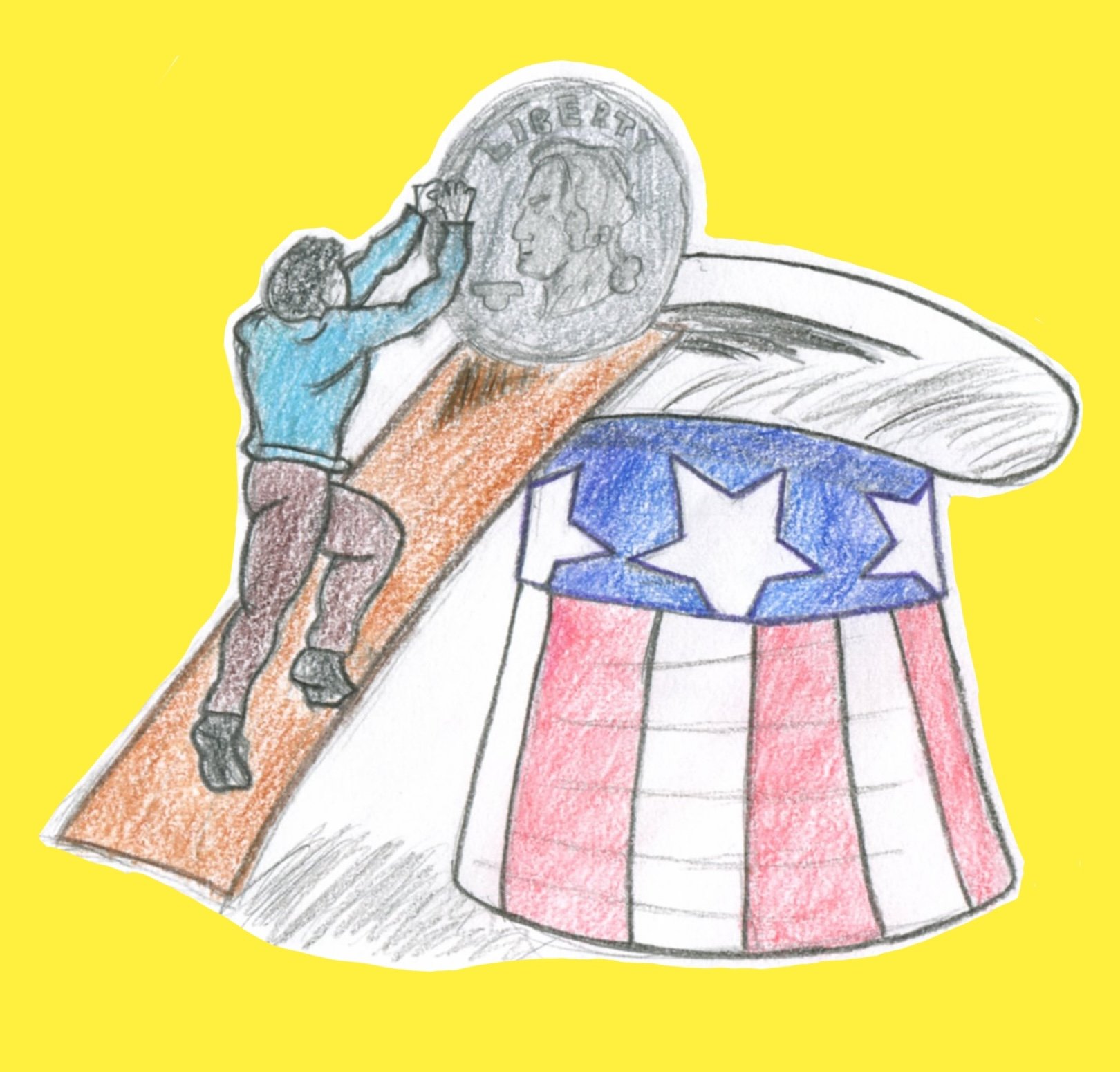

Over-the-Top Government Spending Threatens Our Democracy

America’s debt has exploded to over $34 trillion. In other countries throughout history, irresponsible government spending has led to financial disasters and dictatorships. Art: Sasha Smolansky

The Midwood Argus is an open forum and welcomes a diversity of student opinion. The views expressed in the paper should not be taken to represent those of the administration, faculty, or the student body as a whole. To submit a letter to the editor, click the button on our homepage.

By RAYMOND WU

Are you an evil human being? Do you want to see the homeless scatter the streets or impoverished families starve to death? You don’t? Well then, you better support my trillion-dollar spending bill and my tax hike to fund it, which I promise will in no way affect “normal” people like you!

For years, this has been the prevailing method used by politicians to acquire votes. I mean, who doesn’t want the unfortunate to get free money while someone else pays for it? Of course, it’s never that easy in reality.

While 20th century politics was often dominated by debates on economic policies, the 21st century has seen the culture war take the forefront, meaning there is no greater time for emotionally charged topics to convince the public that the only way to fix a problem is for the government to use your tax dollars to take complete control of a situation.

Because of this, the federal budget has inflated to over $6 trillion a year, according to the Federal Reserve. If you include state and local budgets, this increases to over $10 trillion, or about 38% of all income earned in the United States. In other words, out of every $5 dollars you make or spend, almost $2 winds up in the government’s hands.

This hasn’t been completely funded by taxes, which is why the budget now has a record-breaking deficit of over $1.6 trillion. And whatever portion of the budget isn’t funded still costs the American taxpayer in the form of inflation.

While many culture war discussions these days revolve around border funding or international aid to countries such as Ukraine, such programs are literally miniscule compared to those which cost the most: Social Security (retirement money the government pays to those over age 67) and healthcare.

In the 2023 fiscal year, according to the Congressional Budget Office, the federal government spent $1.3 trillion on Social Security and $1.8 trillion on healthcare, making up about half the budget. These amounts are about four times what they were 20 years ago. And most of this money goes to the elderly. In case you haven’t noticed, America has turned into a gerontocracy – a country governed primarily by the old – one where the elderly are showered with benefits at the expense of young workers.

Social Security and Medicare are funded by payroll taxes, which tax the employee and the employer 7.65% each, no matter what the employee’s income level is. These rates have steadily increased in the past century.

But here’s the thing about Social Security that politicians don’t like to say out loud: If we continue to spend at our current rate, the program will run short of funds by 2033. Unless Social Security is cut, or the tax levied on young workers is increased, the program will cut itself, which will lead to disastrous effects for the elderly and the economy.

As economist Brian Riedl notes, “Current law mandates that when the [Social Security] trust fund balance hits zero… the system will be legally forbidden from borrowing or receiving any more general revenues. Program spending must then fall to match the system’s revenues, and that will mean an automatic across-the-board 23 percent benefit cut. This is not some hypothetical scare tactic, but rather the law that will be implemented if lawmakers continue to refuse reform.”

Other programs that also receive large amounts of tax dollars are defense (the military) and income security (money for the poor). In 2023, defense spending rose to $890 billion and income security to $448 billion.

While it is necessary to maintain our military and help those unable to lift themselves out of poverty, the bureaucracy within these programs has become so large and the spending so excessive, that in many situations, the costs now exceed the benefits. The need for the U.S. military to be omnipresent in the world and the need to manage all aspects of life for the poor bloats the budget and punishes the taxpayer.

There’s also another danger: our increasing reliance on the government. In his iconic book The Road to Serfdom, economist Friedrich von Hayek noted that in 1928 Weimar Germany, the government controlled about 53% of the national income. (Keep in mind, the percentage in our time is creeping close, at 38%.)

Hayek wrote that the people of Germany, as a result of their reliance on the government's economic control of their lives, slowly lost their individual values and were conditioned to accept powerful dictators such as Adolf Hitler and his fascist ideals.

We’ve only come close to this level of government control of the economy twice in our country’s history – once during World War II, when the government had massive control of prices and wages due to the war’s economic effects and high military spending, and then also during Covid, when massive spending bills full of trillions of dollars were passed, sending government spending over 45% of the national income.

This is not to say that such spending makes the ascension of a dictator inevitable, but that our current lack of fiscal responsibility and common sense will lead to a degradation of our individualism and our economy.

The debt caused by government spending is now so high (over $34 trillion total) that the interest payments alone will soon overtake the amount we spend on the military.

But can this be stopped? Will it take a financial disaster’s arrival to change public opinion, or can public opinion change before the disaster arrives?

I think it can. Argentina is in a much worse situation than we are now, and as a response to their crisis, they elected Javier Milei, a president who quickly moved to drastically cut spending and reduce government control over the lives of Argentinians.

What about our future? Only time will tell.